pinellas county sales tax 2020

Driver License Road Test Motor Vehicle and More. 82050 Notice of Sale for a Motor Vehicle.

Florida Reduces Sales Tax Rate On Commercial Leases Mobiliti Cre

You can find more tax rates and allowances for Pinellas County and Florida in the 2022 Florida Tax Tables.

. Groceries are exempt from the Pinellas County and Florida state sales taxes. 82042 Vehicle Identification Number and Odometer Verification. CLICK HERE TO SCHEDULE.

Antonio Tony Horrnik PE -- Project Manager Public Works Transportation Engineering 14 S. Teacher designs can be found by entering the search term teacher Kids Tag Art Pinellas allows us to give back to our local community in a unique and creative way said Pinellas County Tax Collector Charles W. Sales will continue through the end of May 2021.

Five Locations Serving Pinellas County. 2022 List of Florida Local Sales Tax Rates. Pinellas county sales tax rate 2020 How much is sales tax in pinellas county.

05 lower than the maximum sales tax in FL. Pinellas County FL Sales Tax Rate The current total local sales tax rate in Pinellas County FL is 7000. The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales tax.

82053 Power of Attorney for a. 2022 Property Tax Deadline. This is the total of state and county sales tax rates.

This years auction resulted in the sale of 12493 tax certificates collecting more than 41 million. Thomas recently announced the results of the 2020 Pinellas County tax certificate sale held on May 30. Weve been notified that fraudulent emails are being sent to customers under the name of the previous tax collector Diane Nelson stating their account is delinquent and instructing customers to click the attachment for the amount due.

The Penny and sales tax rates Pinellas County has a sales tax rate of 7 percent close to the statewide average rate of 68 percent. 82002 Initial Registration Fee Exemption Affidavit. Pinellas County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Pinellas County totaling 1.

Floridas Sales Tax on Commercial Leases Reduced Again Effective January 1 2020. The Pinellas County sales tax rate is. To the Honorable Board of County Commissioners and the Citizens of Pinellas County Florida.

Floridas statewide sales tax rate is 6 percent but a majority of county governments have a local sales tax of 5 to 2 percent for various purposes including infrastructure public hospitals emergency services transportation indigent care and. 72 rows The plan has been to slowly but surely reduce the sales tax rate on commercial rent to zero and weve seen reductions in the tax rate for several years now. There are a total of 367 local tax jurisdictions across the state.

74039 Authorization to Pay Security. The December 2020 total local sales tax rate was also 7000. There is no applicable city tax or special tax.

Plates can be searched by student first name or school name. The Florida state sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v.

Pinellas County Tax Collector Charles W. 82040 Application for Certificate of Title. 2021 Scott County Sales Tax The exact amount of the tax can vary for different items The sales tax Scott County Arkansas is 913 consisting of 650 Arkansas sales tax.

This years auction resulted in the sale of 12493. This project is funded by the Penny for Pinellas the countys local infrastructure sales tax. PINELLAS COUNTY FL Pinellas County Tax Collector Charles W.

Pinellas County Tax Certificate Sale Results 995 Percent Sold. Lowest sales tax 6 Highest sales tax 75 Florida Sales Tax. However most people will pay more than 55 because commercial rent is also subject to the local surtaxes at a rate where.

The 7 sales tax rate in Pinellas Park consists of 6 Florida state sales tax and 1 Pinellas County sales tax. 12302019 by Trenam News and Gregory R. 995 percent of the 12559 available.

Thomas is pleased to announce the results of the 2020 Pinellas County tax certificate sale held on May 30. The minimum combined 2022 sales tax rate for Pinellas County Florida is. Florida is the only state in the country that imposes a comprehensive sales tax on commercial real estate leases.

The Comprehensive Annual Financial Report Annual Report of Pinellas County Florida for the fisc al year ended September 30 20 20 is hereby respectfully submitted in accordance with Chapter 21832 of the Florida Statutes. On January 1 2020 the state tax rate was reduced from 57 o 55. You can print a 7 sales tax table here.

The local sales tax rate in Pinellas County is 1 and the maximum rate including Florida and city sales taxes is 75 as of March 2022. Certificate holders use Lienhub to run estimates and make application for tax deed. Average Sales Tax With Local.

The Pinellas County Sales Tax is collected by the merchant on all qualifying sales made within Pinellas County. Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15. Lower sales tax than 87 of Florida localities.

Real Estate Blog Being A Landlord Rent Rent Vs Buy

Florida Unemployment Recipients Say State Failing To Provide Crucial 1099 G Tax Form Wfla

Summer 2020 Usf Commencement Program By Usf Commencement Issuu

Millage Rates Pinellas County Tax

Tax Certificate And Tax Deed Sales Pinellas County Tax

Kta Sales Open 2020 Pinellas County Tax

Kta Sales Open 2020 Pinellas County Tax

Your Property Tax Bill Forward Pinellas

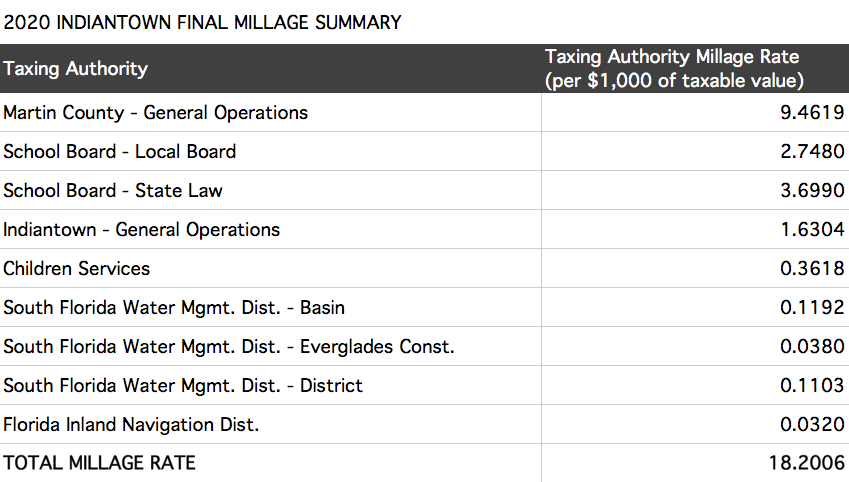

Martin County Property Appraiser 2020 Millage Codes Tax Rates

Pinellas County Taxable Values Rise 7 27 In 2020 Firstpointe Advisors Llc